Can CREATE pave its way to April 15 ITR filing?

By Atty. Rodel C. Unciano

"Once passed into law, CREATE will reshape corporate income taxation in the country beginning with the reduction of corporate income tax effective July 1, 2020, from the current thirty percent (30%) to twenty five percent (25%) and to the lower corporate income tax of twenty percent (20%) for domestic corporations with total assets not exceeding one hundred million pesos, excluding land, and total net taxable income of not more than five million pesos. Also, for a period of three (3) years from July 1, 2020 until June 30, 2023, the Minimum Corporate Income Tax (MCIT) will be lowered to one percent (1%) from the current rate of two percent (2%)."

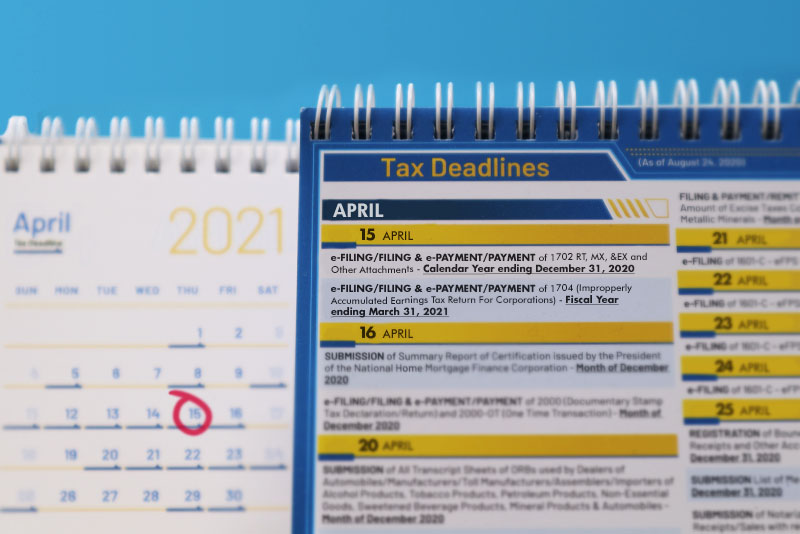

As of this writing, the CREATE bill or the Corporate Recovery and Tax Incentives for Enterprises Act is yet to be signed by the President. We have barely a month before the April 15 deadline for filing of Annual Income Tax Return (ITR) for most taxpayers but affected taxpayers could not as yet finalize their tax calculations as the signing of the CREATE bill into law is certainly a factor that will largely impact on the final determination of their income tax due for the year 2020.

Will CREATE bill be able to pave its way to the April 15 deadline? Will the President exercise its power to veto the bill? How will it be implemented?

The enrolled bill was presented to the President last February 24, 2021 for approval. Under the Constitution, the President is given thirty (30) days from receipt of the bill within which to approve or veto the same. If he approves the same, he shall sign it. Otherwise, he shall veto it and return the same with his objections to the House. The President shall communicate his veto to the House within thirty (30) days after the date of receipt thereof, otherwise, the bill shall become a law as if he had signed it. So therefore, if the President does not veto or approve the bill into law within the thirty (30) day period provided under the Constitution, the bill will lapse into law by March 26, 2021.

The enrolled bill was presented to the President last February 24, 2021 for approval. Under the Constitution, the President is given thirty (30) days from receipt of the bill within which to approve or veto the same. If he approves the same, he shall sign it. Otherwise, he shall veto it and return the same with his objections to the House. The President shall communicate his veto to the House within thirty (30) days after the date of receipt thereof, otherwise, the bill shall become a law as if he had signed it. So therefore, if the President does not veto or approve the bill into law within the thirty (30) day period provided under the Constitution, the bill will lapse into law by March 26, 2021.

And once the CREATE bill becomes a law either by approval of the President or by his failure to act on it within the thirty (30) day period, we will have to wait for another fifteen (15) days after its complete publication in the Official Gazette or in a newspaper of general circulation before it finally becomes effective. And it is only upon its effectivity that the Secretary of Finance can promulgate the necessary rules and regulations for its effective implementation.

Given the timeline, it would be a good measure to extend the April 15 deadline for ITR filing, at least for corporate taxpayers, to give them more time to adapt to the new rules. This will likewise give more time for the BIR and the Secretary of Finance to promulgate the implementing rules and regulations necessary for the effective implementation of the Act.

Once passed into law, CREATE will reshape corporate income taxation in the country beginning with the reduction of corporate income tax effective July 1, 2020, from the current thirty percent (30%) to twenty five percent (25%) and to the lower corporate income tax of twenty percent (20%) for domestic corporations with total assets not exceeding one hundred million pesos, excluding land, and total net taxable income of not more than five million pesos. Also, for a period of three (3) years from July 1, 2020 until June 30, 2023, the Minimum Corporate Income Tax (MCIT) will be lowered to one percent (1%) from the current rate of two percent (2%).

Also, proprietary educational institutions and hospitals which are nonprofit will pay a corporate income tax rate of one percent (1%) instead of the current rate of ten percent (10%) effective July 1, 2021 to June 30, 2023. Small businesses, with sales under three million pesos will pay one percent (1%) of gross sales instead of three percent (3%) from July 1, 2021 to June 30, 2023. Registered enterprises that fully relocate outside Metro Manila will be entitled to an additional three (3) years of income tax holiday (ITH) while registered enterprises that locate in areas recovering from disasters or conflict will be entitled to an additional two (2) years of ITH.

There are several other changes introduced in CREATE which are more worthy of discussion once it is signed into law.

The author is a partner of Du-Baladad and Associates Law Offices (BDB Law), a member-firm of WTS Global.

The article is for general information only and is not intended, nor should be construed as a substitute for tax, legal or financial advice son any specific matter. Applicability of this article to any actual or particular tax or legal issue should be supported therefore by a professional study or advice. If you have any comments or questions concerning the article, you may e-mail the author at This email address is being protected from spambots. You need JavaScript enabled to view it. or call 8403-2001 local 140.